A low inventory of homes for sale has remained a huge challenge for buyers. A national housing shortage, caused in good measure by new home construction failing to keep up with demand, will likely take decades to recover. But other changing economic conditions, particularly those that affect mortgage interest rates, could help increase opportunities for buyers and sellers in the coming months.

A low inventory of homes for sale has remained a huge challenge for buyers. A national housing shortage, caused in good measure by new home construction failing to keep up with demand, will likely take decades to recover. But other changing economic conditions, particularly those that affect mortgage interest rates, could help increase opportunities for buyers and sellers in the coming months.

The 30-year fixed mortgage interest rate has dropped from nearly 8 percent in October 2023 to about 6.68 percent today, according to data on Mortgage News Daily. In early September this year, it hovered closer to 6 percent. Not surprisingly, we saw increased real estate activity in September 2024 compared to September 2023. Although the number of closed home sales in our region is similar to last year, Bright MLS reports that the number of pending sales climbed 15.7 percent, and home showings are up 5.9 percent compared to September 2023, and the supply of homes for sale increased by 18.9 percent, all of which are hopeful signs for buyers.

Bright MLS reports similar trends within the larger mid-Atlantic region noting: “Results from Bright MLS’s latest survey reveal that buyer challenges are easing as sellers add more homes to the market.” According to that survey, usually two-thirds of the people selling homes are looking to buy another, so more listings also increase the buyer pool. However, according to this year’s research, fewer sellers—just under half—are looking to buy right now. Some of these sellers appear to be holding off for now, but a good number don’t have plans to buy. For example, Bright MLS reports that 36.6 percent of the homes sold were not primary residences, but rather vacation homes, investment properties, or homes sold as part of an estate sale.

Going forward, however, the more important trend may arise from declining interest rates, should substantial reductions occur moving into 2025. “Mortgage rates should continue declining this year as the U.S. economy weakens, inflation cools, and the Federal Reserve continues to cut interest rates,” says Erika Giovanetti, Loans Expert and Reporter for U.S. News and World Report. She maintains that the rate for a 30-year fixed mortgage should fall to a low 6 percent range by the end of this year and decline further into the high 5 percent range in early 2025.

According to a story in Reuters: Goldman Sachs “expects the U.S. Federal Reserve to deliver consecutive 25-basis-point (bps) interest rate cuts from November 2024 through June 2025 to a terminal rate range of 3.25-3.5%.” That does not mean mortgage rates would drop to that level, but the Federal Reserve’s federal funds rate affects what banks eventually will offer for mortgage rates. Right now, the federal reserve rate is 4.75 percent to 5 percent, and many lenders are offering mortgage rates just under 7 percent.

Additional reductions in the federal funds rate could bring rates down closer to 5.5 percent by the end of 2025, according to some reports. If so, that might not only bring out more buyers, but it could also increase housing inventory by encouraging more sellers to put their homes on the market.

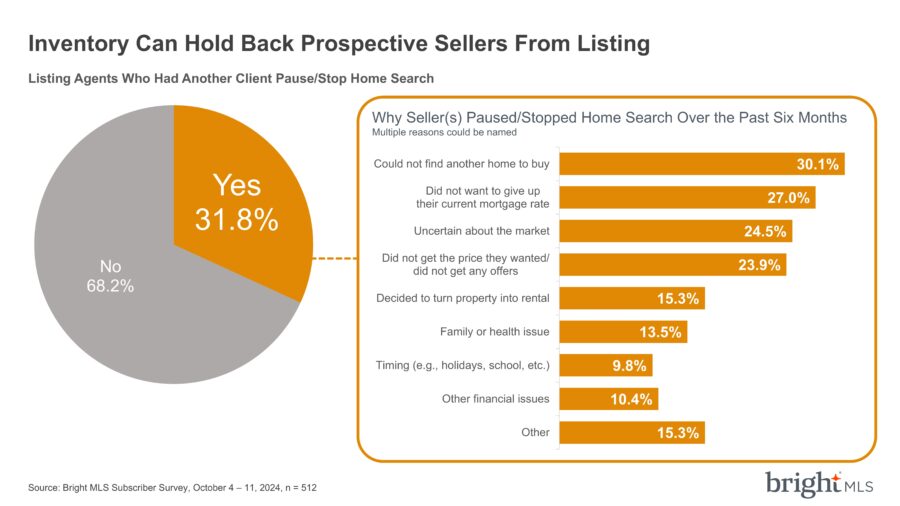

In fact, the data in the following chart shows that a large number of sellers have stopped trying to sell because they can’t find another home to buy (30.1 percent) or because they have a very low interest rate on their current mortgage (27 percent) compared to what they can get for a purchase. So, if and when rates go down, more sellers put their homes on the market thereby increasing inventory and leading additional homeowners to list their homes.

In any case, affordability will remain a problem for many buyers, particularly in our region, where in September 2024 the median price for homes sold was $599,000 for all categories of homes, up 8.9 percent from last year. Broken down by category, the median price for a single-family home is $760,000, $585,000 for a townhome, and $375,000 for a condo. September 2024 closed prices did dip by 2.1 percent compared to August of 2024, which Bright MLS explains is a “typical seasonal pattern.”

For those who can afford to buy, more opportunities may appear on the horizon. And homes in our region will likely remain a good investment over the long haul because the region remains highly desirable, and there is not enough home building to keep up with demand, which will likely remain a long-term issue.