The Washington D.C. region real estate market has slowed, and it appears more balanced than it has in many years. Comparing April 2025 to April 2024, homes now are in active status longer and the number of homes added to the market is increasing, giving buyers more time and options. Meanwhile, regional home prices continue to rise, which benefits sellers.

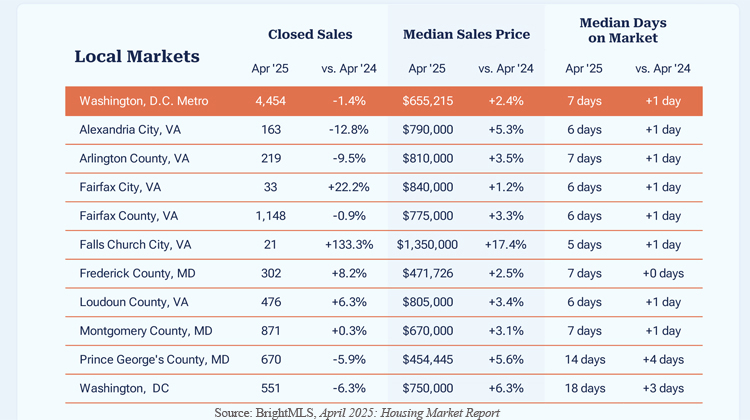

Bright reports that there were 49.4 percent more active listings at the end of April 2025 than there were at the end of April 2024, and new listings are up 1.7 percent. The number of overall sales has dropped by 1.4 percent, and the median days on market has increased from six to seven days. Pending sales are also down by 6.6 percent. So, you might think prices would drop too, but they haven’t. The median sold price regionally has increased from $640,000 to $655,215.

It remains unclear as to whether the market is experiencing a temporary dip or if we are entering a longer-term downward trend. BrightMLS data show that January to April closings this year are still up by 0.2 percent compared to the same period last year. If interest rates dip a bit later in the year and market volatility settles down, the final sales figures for the year might still rise above last year.

In any case, these most recent numbers indicate that 2025’s spring market is presenting more opportunities for buyers, and buyers may also have more time to make their offers than in recent years. Prices remain high, and mortgage rates have been hovering in the high 6 percent range, making affordability an ongoing concern. And we are still seeing multiple offers on some homes, particularly those in mint, move-in condition. Buyers who moderate their “must-have list” or consider homes that need some work, might see additional opportunities and get a better deal.

With market volatility and concerns about government workforce reductions, we have seen some buyers decide to hold off, but that may be changing for May. A story in Housing Wire last Friday (May 9, 2025) indicated mortgage applications were up this past week as interest rates dipped a little bit. Housing Wire notes:

After months of hovering in the high 6% range—and most recently dipping to 6.84%— declining mortgage rates may finally be luring buyers back. Applications rose 11% last week, according to the Mortgage Bankers Association (MBA), as mortgage executives report renewed activity in the market. And several say it will be even stronger when this week’s stats are tallied by the MBA.

What does this mean for sellers? If you list, chances are good you will get a great price for your home, but it may take a little longer, and you need to make sure your home really stands out. That means ensuring it shows best, is clean, and is staged with awesome photos to attract the most buyers possible. But before engaging in upgrades, it’s best to consult with a Realtor who can tell you which improvements will yield the best rate of return.

Of course, all real estate is local, so each county, city, and neighborhood has a unique position in the market. Right now, Washington, D.C. is the slowest market with the median days on market at 18, while Falls Church City is the fastest-selling market with average days on market at five. All counties and cities have seen price increases. Some jurisdictions—Falls Church City, Frederick County, Md., Loudon County and Montgomery County—saw increased closings in April 2025 compared to April 2024. Fairfax County is close, with a reduction of closings by only 0.9 percent in April compared to a year ago. Alexandria City with 12.8 percent fewer closings, and Arlington with a reduction of 9.5 percent fewer closings, have slowed the most. Yet prices have gone up 5.3 percent and 3.5 percent respectively in those jurisdictions. See more details in the chart below.

For more data by region, see the market snapshots on our website, which update monthly. For a full copy of Bright MLS’s monthly market report in PDF, reach out to us.

Leave a Reply